5 Types of Adjusting Entries

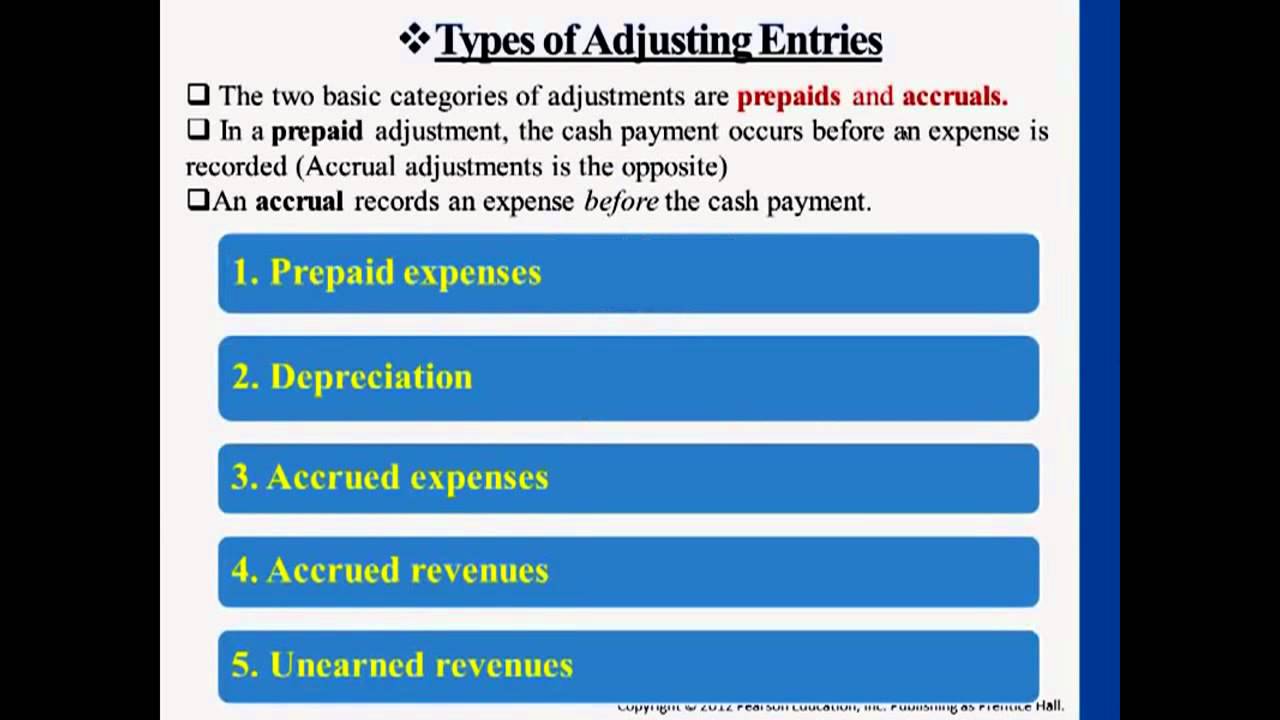

Some common types of adjusting journal entries are accrued expenses. Types of Adjusting Entries Adjusting entries which are required in order to have a companys financial statements comply with the accrual method of accounting are often categorized into.

What Are Adjusting Entries Definition Types And Examples

There are only five of them and its easy to figure out what is the main difference between them all.

. These adjusting journal entries directly reflect the financial stability of that company which provides an upper hand in the market. Adjusting Entries is the fourth step in the accounting cycle and commonly used in accordance with the matching principle to match revenue and expenses in the period in which. An adjusting journal entry is a financial record you can use to track unrecorded transactions.

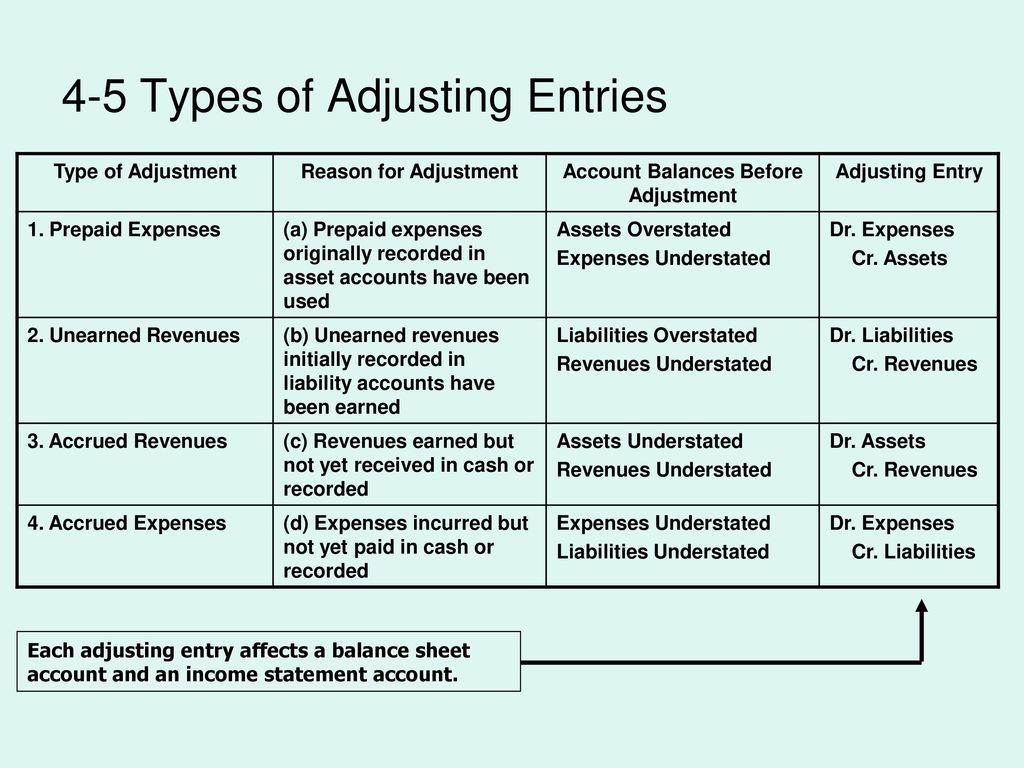

Adjusting entries can be divided into the following four types. Accrued Income income earned but not yet received Accrued. The five types of adjusting entries.

Accrued revenues When recording accrued revenues on an income statement you. Start studying 5 types of adjusting journal entries. The following are five common types of adjusting entries that a business may use.

Deferred revenue often refers to advance payments a company. Types of Adjusting Entries Generally there are 4 types of adjusting entries. The process through which an amount of money is added or deducted from the ledger balances to make the balances up to date is.

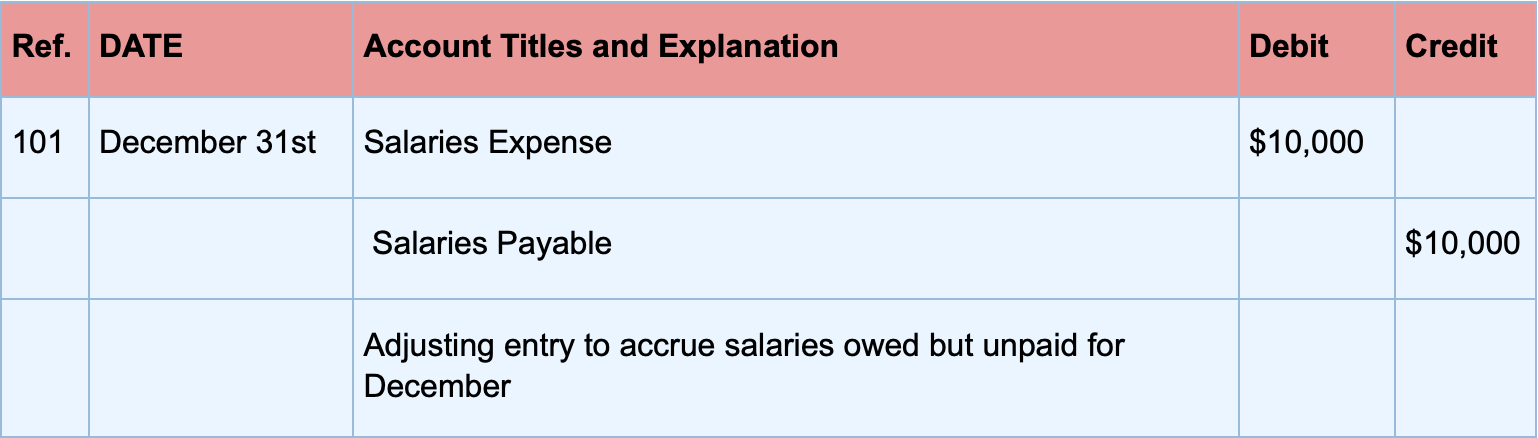

5 Types of Adjusting Entries JE Journal Entry ADJ Adjusting Journal Entry 1. March 28 2019. The following are five common types of adjusting entries that a business may use.

Each month accountants make adjusting entries before publishing the final version of the monthly financial statements. Learn vocabulary terms and more with flashcards games and other study tools. Adjusting entries that convert assets to expenses.

All five of these entries will directly impact both your revenue and. Adjusting entries are made at the end of an accounting period after a trial balance is prepared to adjust the revenues and expenses for the period in which. There are several types of adjusting.

View Notes - 5 Adjusting Entries Updateddocx from ACC 5270 at Wayne State University. 5 Types of Adjusting Entries. Adjusting entries are prepared for the following.

Deferred revenue Deferred revenue often refers to advance payments a company receives. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. Some cash expenditures are made to obtain benefits.

When you generate revenue in one accounting period but dont recognize it until a later period you need to make an accrued. Here are some types of adjusting entries to consider when reviewing your revenue. Lets describe all the types of adjusting entries you can come across.

Adjusting The Accounts Ppt Download

Adjustment By Sara Alsager Ppt Video Online Download

Adjusting Entries Meaning Types Importance And More

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

Adjusting Entries Definition Types Examples

Types And Rules For Adjusting Entries Professor Victoria Chiu Youtube

Comments

Post a Comment